Finance Secretary Ralph G. Recto has invited Australian investors to be part of the Philippines’ ‘blockbuster’ growth story, emphasizing that the country has rolled out the red carpet and reserved the best seat for them during the Philippine Business Forum in Melbourne, Australia.

“This is an exciting opportunity that Australian investors should certainly not miss out on,” he told around 100 Australian business and investment leaders and government officials during his speech on March 4, 2024 at the Ritz Carlton in Melbourne, Australia.

Secretary Recto laid out that the Department of Finance (DOF) has a comprehensive plan to drive investments-led growth through its Growth-Enhancing Actions and Resolutions (GEARs), which works in tandem with the government’s fiscal consolidation plan––the Medium-Term Fiscal Framework (MTFF).

“A key aspect of this strategy is welcoming investors with open arms to achieve investments-led growth through improvements in the regulatory regime, reduction in the cost of doing business, and addressing constraints,” he said.

The Finance Chief emphasized that President Ferdinand Marcos Jr.’s swift enactment of the Public-Private Partnership (PPP) Code of the Philippines is a resounding testament to the government’s commitment to fostering stronger collaboration with the private sector.

Signed into law on December 5, 2023, the PPP Code offers a stable, predictable, and competitive environment where high-quality PPP investments can thrive.

It leverages over three decades of experience with the Build-Operate-Transfer (BOT) Law and integrates best practices to streamline processes, reduce transaction costs, and enhance the ease of doing business for PPPs.

Secretary Recto urged Australian investors to invest in the country’s flagship infrastructure projects primed and ready for PPP investments under the President’s Build Better More program.

The program features 185 big-ticket infrastructure projects worth PHP 9.14 trillion (about USD 163 billion) ranging from power, physical connectivity, rural development, water resources, digitalization, sustainable initiatives, and healthcare.

The Finance Secretary said the government’s swift approval of the solicited PPP proposal to rehabilitate the Ninoy Aquino International Airport (NAIA), which was the fastest approved PPP project in history evaluated in an unprecedented six weeks, is a testament to how quickly and efficiently the Philippine government acts on investments.

“Rest assured, you can expect nothing less than the same speed and efficient handling of your investments when you partner with us,” he said.

Apart from the Build Better More program, Secretary Recto likewise pitched that investors have the option to invest in other big-ticket projects through the Maharlika Investment Fund (MIF)––the Philippines’ first sovereign wealth fund.

Moreover, the Philippines also warmly welcomes expanded investment opportunities, particularly in telecommunications, transportation, banking, mining, and energy sectors, following the recent implementation of its liberalization laws and other pro-business policies.

The amendments to the Retail Trade Liberalization Act (RTLA) lowered the minimum paid-up capital requirement for foreign corporations from about USD 2.5 million to around USD 500,000 as well as streamlined the qualification requirements for foreign retailers.

Meanwhile, 100% foreign ownership of public services is now possible through the amendments to the Public Service Act (PSA).

The amendments to the Foreign Investments Act (FIA), on the other hand, improved the Philippines’ openness to foreign direct investments (FDIs) and liberalized the practice of professions.

The country is also now open to full foreign ownership of renewable energy projects through the amendments in the implementing rules and regulations of the Renewable Energy Act of 2008.

The government is also refining the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE) Act to further tailor fit incentives to investor interests and encourage investment in strategically important sectors.

“All these complement the investment and capital market reforms we are pursuing to align all of our initiatives with the best practices of major Asian peers,” Secretary Recto added.

With the Philippines’ very young and well-educated population (median age of 25) which stands in contrast to Australia’s aging population (median age of 41), Secretary Recto also broached a proposal for the two countries to become demographic partners.

“Our young, tech-savvy, English-speaking workforce complements Australia’s forward-thinking businesses and highly skilled labor force. This sweet spot provides an opportunity for the Philippines and Australia to become demographic partners,” he stressed.

Aside from the business-friendly policies, Secretary Recto showcased the Philippines’ promising growth story, which makes it the most strategic choice for investments and partnerships in the ASEAN region.

“Keep in mind that you are teaming up with the fastest-growing economy in Asia. Our resilience has been tested and proven strong,” he said.

The Philippine economy grew the fastest in the ASEAN region in 2023, expanding by 5.6%.

Multilateral organizations affirm the strength of the Philippine economy, expecting it to maintain its position as a frontrunner in ASEAN with a projected GDP growth of 5.8% to 6.3% in 2024.

The Finance Chief noted the continued deceleration of the inflation rate in the country and said the DOF’s comprehensive Reduce Emerging Inflation Now (REIN) plan will ensure that this will stay within the government’s target band of 2% to 4% for the year.

Moreover, the Philippines boasts a vibrant labor market with an unemployment rate reaching a record low of 3.1% in December 2023 along with the continued reduction in the underemployment rate and faster labor force growth.

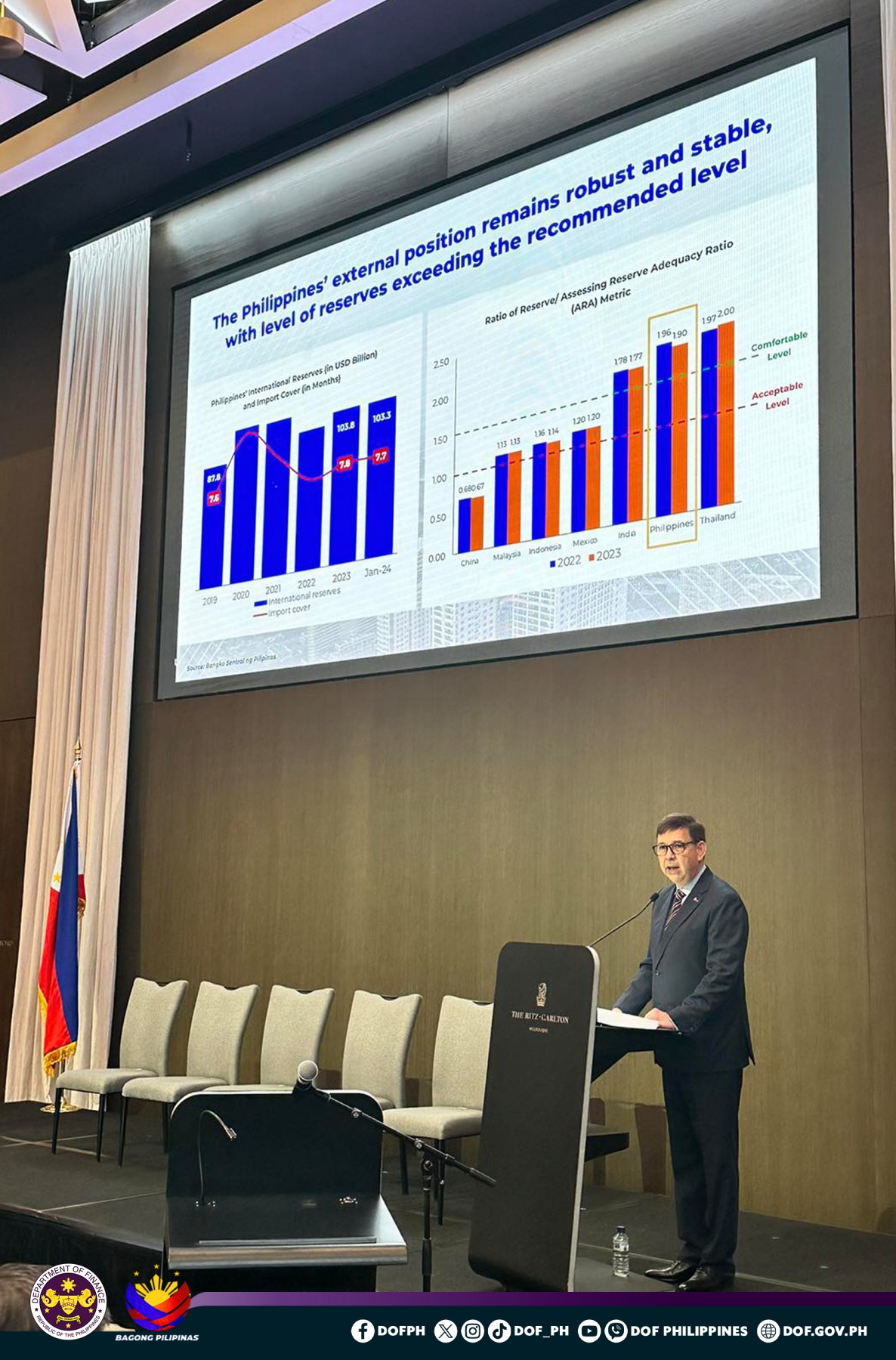

Secretary Recto likewise highlighted that the Philippines’ external position remains strong and stable, with the ratio of its reserves in 2023 over the International Monetary Fund’s (IMF) assessing reserve adequacy metric reaching 1.9–exceeding the recommended level and significantly higher than China’s 0.67, Malaysia’s 1.13, and Indonesia’s 1.14.

“This means we have a sufficient buffer against global economic headwinds,” he said.

In addition, the Philippines has continued to have the lowest external debt-to-GDP ratios among the ASEAN-5 countries, reaching 28.1% in the third quarter of 2023.

“This makes us the least vulnerable nation to adverse external shocks,” the Finance Chief added.

Secretary Recto also assured investors that the country’s fiscal performance remains robust and on track with the MTFF with its fiscal deficit and national government debt-to-GDP ratio on a downward trend from its peak during the pandemic.

Meanwhile, the government enjoys consistently higher government revenue collections and improved expenditure management, which prioritizes massive infrastructure projects, and social services––particularly education.

This adherence to fiscal discipline and prudent debt management enabled the country to maintain its high credit ratings amid the sea of downgrades globally.

“See for yourself how we prioritize prudent economic management to ensure stability for business,” the Finance Chief said.

The Philippine Business Forum served as an opportunity to showcase the strength of the Philippine economy to potential Australian investors, as well as encourage two-way trade and investments between the two countries.

The forum was organized by the Department of Trade and Industry (DTI) in partnership with the Australia-Philippine Business Council (APBC), the Philippines-Australia Business Council (PABC) and the Australia-New Zealand Business Chamber (ANZCHAM).

It was conducted on the sidelines of the ASEAN-Australia Special Summit, which will be held from March 3 to 6, 2024. Secretary Recto is part of President Marcos, Jr.’s delegation of the said official travel.

Key business and government leaders who delivered respective presentations during the forum were President of ANZCham Benjamin Romualdez; Department of Energy (DOE) Secretary Raphael P.M. Lotilla; Board Director of the Philippine Nickel Industry Association (PNIA) Atty. Ryan Jornada; Philippine Economic Zone Authority (PEZA) Director General Tereso Panga; CEO of the Victoria International Container Terminal Bruno Porchietta; and President and CEO of AC Energy Corporation (ACEN) Eric Fracia.

President Marcos, Jr. graced the occasion and delivered a keynote address before the Australian investors and business leaders. Meanwhile, key business agreements between the Philippines and Australia were also presented during the forum.

Other executives from select Australian companies who were present during the event were President of the APBC Rafael Toda; Founder and Deputy Chairman of St Baker Energy Innovation Fund Trevor Charles St Baker AO; Director of Medgate (Asia) Holdings Pty Limited David King; Head of Infrastructure & Energy Capital in the Asia Pacific of Macquarie Capital Ivan Varughese; and Chairman of the PABC Atty. Dennis Quintero.

###