The Philippine government’s economic team has urged British investors to choose the Philippines, and the country will deliver on bringing significant returns and opportunities for British businesses to grow and prosper in its expanding domestic market.

“If you are looking for a place to grow your business and make more money, I’d say: Choose the Philippines. Make it happen in the Philippines. Because there is no other country in the world, at this moment, that holds so much potential to boost your investments,” Finance Secretary Ralph G. Recto said in his keynote address at the Philippine Economic Briefing (PEB) in London on October 31, 2024.

The PEB in London served as a platform to highlight the Philippine government’s current initiatives to further improve the ease of doing business and fast-track economic progress.

According to Secretary Recto, among the strategic investment advantages of the Philippines is its vibrant labor force with a young, well-educated, and English-speaking workforce.

“If there is one country that can stand witness to the best that the Philippines can give the world, it is most probably the United Kingdom. The presence of around 250,000 Filipinos here in the UK today is a testament to this, with more or less a fifth of them providing critical services to the British healthcare system,” he said.

“And let us not forget, it was a Filipina nurse in the UK who administered the world’s first COVID-19 vaccine. This is a powerful symbol of what happens whenever and wherever you open an opportunity for Filipinos, we will always deliver,” he stressed.

Secretary Recto likewise spotlighted the country’s stable political environment, strong economic potential, on-track fiscal consolidation path, healthy external accounts, growing middle class, and the country’s decelerating inflation rate as key factors creating a more conducive investment climate for British enterprises to flourish in the Philippines.

Given that the Euro market has been a vital source of financing for the Philippines, the Finance Chief urged British investors to increase financial integration, especially as the country enters into JP Morgan’s Bond Index soon.

This is expected to boost investor interest in Philippine government bonds, potentially lowering borrowing costs and improving market liquidity.

With the new Public-Private Partnership (PPP) Code, he also encouraged business leaders to submit unsolicited proposals, respond to solicited ones, or explore more joint ventures with the Philippines on its 186 flagship infrastructure projects.

With the Philippine Digital Infrastructure Project and the National Broadband Program in place, the Secretary said the Philippines is ready to become the hotspot for the UK’s technology-driven businesses such as hyper-scale data centers.

To fuel this digital transformation, Secretary Recto explained that the government has developed an Artificial Intelligence roadmap and strategy to upskill and retool the Filipino workforce.

To facilitate British investors’ swift entry into the Luzon Economic Corridor, he likewise announced that the government will soon enact new amendments to its fiscal incentives regime, known as the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE).

“This policy is specifically designed to address your concerns and tailor fiscal and non-fiscal incentives to meet your specific needs,” he told investors.

The CREATE MORE bill further streamlines business compliance by reducing documentary requirements, and resolves value-added tax (VAT) concerns by exempting export-oriented enterprises from paying the latter.

It also offers a very competitive incentive package for projects with investment capital exceeding GBP 199.67 million (PHP 15 billion).

Meanwhile, registered business enterprises benefit from a reduced corporate income tax rate of 20%.

The maximum duration of tax incentives availment will be extended from 17 years to 27 years. Incentives for labor-intensive projects can even be extended for another decade.

Registered business enterprises will likewise benefit from the 200% deduction on power expenses and an additional 50% reduction for reinvestment allowances on priority tourism projects or activities.

Secretary Recto also told investors to watch for a proposal to reduce the tax on stock transactions from 0.6% to just 0.1%, which will lower friction costs and align the Philippines with its regional peers.

“It has been long proven: just give Filipinos the opportunity and watch them deliver their best. So I am urging you to bet on us. Make the wise decision to invest in the Philippines. And we will deliver,” he underscored.

For the first time in five years, the UK is the Philippines’ number one source of foreign direct investment (FDI) inflows, with GBP 585.74 million (PHP 44.13 billion) worth of investments to the Philippines as of the end of July 2024––4,230% higher than the previous year.

Moreover, the UK is the country’s eighth-largest source of tourist arrivals; the fifth-biggest source of overseas Filipino remittances; top 21st trading partner of the Philippines.

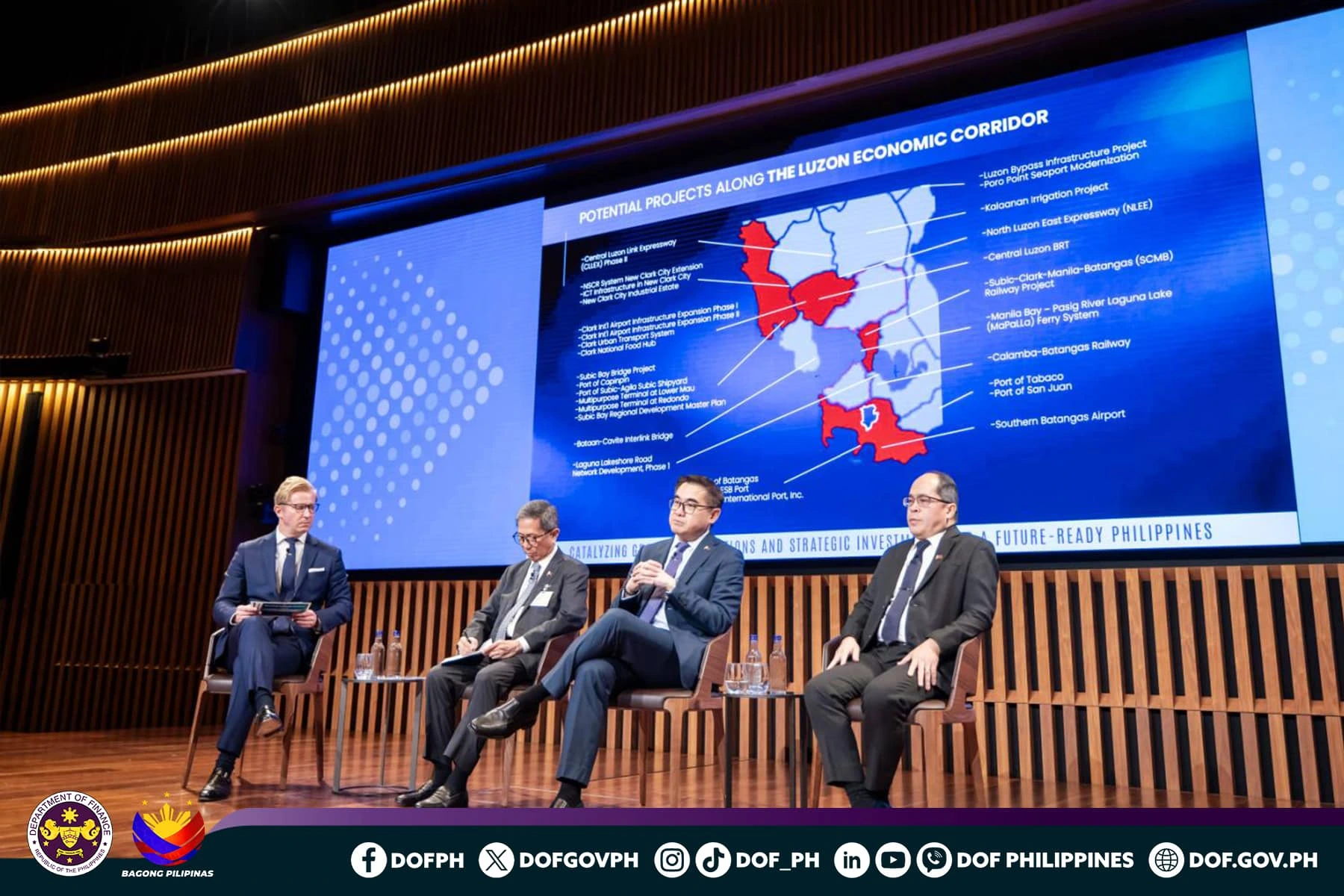

During the first panel discussion on building the foundation for a competitive future, Secretary Recto was joined by National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan; Department of Budget and Management (DBM) Undersecretary Joselito R. Basilio; BSP Deputy Governor Francisco G. Dakila, Jr.; and Citi Managing Director and Head of the Public Sector Group Michael Paulus.

This was followed by a panel discussion on innovations and strategic investments for the future-ready Philippines led by Office of the Special Assistant to the President for Investment and Economic Affairs (OSAPIEA) Secretary Frederick D. Go; Department of Energy (DOE) Secretary Raphael P.M. Lotilla; Bases Conversion and Development Authority (BCDA) President and CEO Joshua M. Bingcang; Philippine Economic Zone Authority (PEZA) Director General Tereso O. Panga; Clark Development Corporation (CDC) President and CEO Agnes VST Devanadera; and Land Bank of the Philippines President and CEO Ma. Lynette V. Ortiz.

Meanwhile, Pru Life UK President and CEO Sanjay Chakrabarty delivered a testimony about the predictability, stability, and sustainability of doing business in the Philippines.

Filipino business leaders also joined the event to forge partnerships with British investors, namely Vista Land and Lifescapes, Inc. Chairman Manny Villar, Converge ICT CEO Dennis Uy, and Globe Telecom Chief Financial Officer Carlos Puno.

Also present were Philippine Ambassador to the UK Teodoro L. Locsin, Jr.; Ambassador Manuel Antonio Teehankee, Permanent Representative of the Philippine Permanent Mission to the World Trade Organization; and Deputy House Speaker Camille Villar.

About 220 senior executives and representatives of UK-based corporations, industry associations, and financial communities attended the event.

Aside from the briefing, the delegation had one-on-one meetings with top-tier British companies including Actis, BP Plc, Global Infrastructure Partners, InvestCorp, Alexander Mann Solutions, and Revolut.

They also met with the British International Investment and the UK ASEAN Business Council as well as participated in an off-the-record roundtable discussion with British investors hosted by Asia House.