Finance Secretary Ralph G. Recto has assured Japanese investors that the ongoing amendments to the country’s fiscal incentives system will address their key concerns, giving birth to more thriving economic corridors in every corner of the Philippines–starting with the Luzon Economic Corridor.

“CREATE MORE [Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy] enhances both fiscal and non-fiscal incentives while addressing key concerns of Japanese investors,” he said in his keynote speech at the Philippine Economic Briefing (PEB) in Tokyo on June 21, 2024.

The CREATE MORE is an improved version of the CREATE law that expands and refines fiscal and non-fiscal incentives; clarifies the rules and policies on the grant and administration of incentives; and addresses key issues affecting the country’s investment climate.

It solves Japanese investors’ long-standing concern about value-added tax (VAT) refunds by exempting export-oriented enterprises from paying the latter.

Meanwhile, the VAT refund reforms under the CREATE MORE will also address investors’ concerns regarding the unreliability of the system, making it timely, efficient, and predictable.

The bill also provides a more attractive incentive package for registered projects or activities with an investment capital exceeding about PHP 15 billion.

The doubling of the additional power expense deduction will also help mitigate the impact of high power costs and reduce the overall cost of doing business in the Philippines, given its income tax effect.

The Finance Chief underscored that CREATE MORE will bolster the country’s investment attractiveness, enticing more Japanese investors to establish roots and expand in the Luzon Economic Corridor.

The economic corridor is the first of its kind in the Indo-Pacific region and was established during the inaugural Trilateral United States-Japan-Philippines Leaders Meeting last April.

“We envision CREATE MORE to give birth to more thriving economic corridors in every corner of the Philippine archipelago, with Japan taking a leading role,” Secretary Recto added.

Aside from massive infrastructure investments that the Japanese investors can participate in, Secretary Recto said the corridor is a perfect hub for those involved in cutting-edge manufacturing, semiconductor supply chains, and agribusiness as this links Luzon’s major economic centers—Subic Bay in Zambales, Clark in Pampanga, Manila, and Batangas.

On top of this, the Philippine government has been actively addressing bottlenecks and streamlining processes to make it easier for Japanese investors to engage in high-priority sectors such as clean energy, mining, critical minerals, retail, digital technologies, and many others.

The Public-Private Partnership (PPP) Code offers a stable, predictable, and competitive environment for PPPs to flourish, easing Japanese investors’ participation in the 185 flagship infrastructure projects under the Build Better More program.

“We invite you to submit unsolicited proposals for our PPP projects, respond to solicited proposals, or enter into joint venture agreements,” the Finance Chief urged Japanese investors.

Aside from this, Secretary Recto also showcased other pro-business and economic liberalization policies that the country has in place to foster a welcoming environment for businesses and encourage foreign partnerships.

These include the amendments to the Retail Trade Liberalization Act (RTLA) that lowers the minimum paid-up capital requirement for foreign retail corporations; changes to the Public Service Act (PSA) that allow full foreign ownership of public services, such as telecommunications, airports, and shipping; and amendments to the Foreign Investments Act that promotes foreign direct investments and eases restrictions on professions.

Furthermore, the amendments to the implementing rules and regulations of the Renewable Energy Act of 2008 granted full foreign ownership of renewable energy projects.

The Green Lane Endorsement expedites, streamlines, and automates government approval and registration processes of priority investments and strategic investments.

On the other hand, the Philippine Domestic Submarine Cable Network (PDSCN) provides inclusive connectivity across the archipelago, positioning the country as an attractive host for technology-centric businesses such as hyper-scale data centers, smart manufacturing, and high-tech agriculture.

Additionally, the proposed Rationalization of the Mining Fiscal Regime unlocks the mining sector’s full potential by enhancing the predictability of the country’s mining policies.

“These reforms are just a fraction of the transformative changes underway in the Philippines to make us stand out as the most hospitable economy for Japanese enterprises,” Secretary Recto stressed.

“We are committed to working non-stop until good becomes better and better becomes the best for business,” he said.

The Finance Chief pointed out that these reforms, along with the country’s booming economy and the strategic complementarities of Japan and the Philippines, make the latter the most strategic safe haven for Japanese investors.

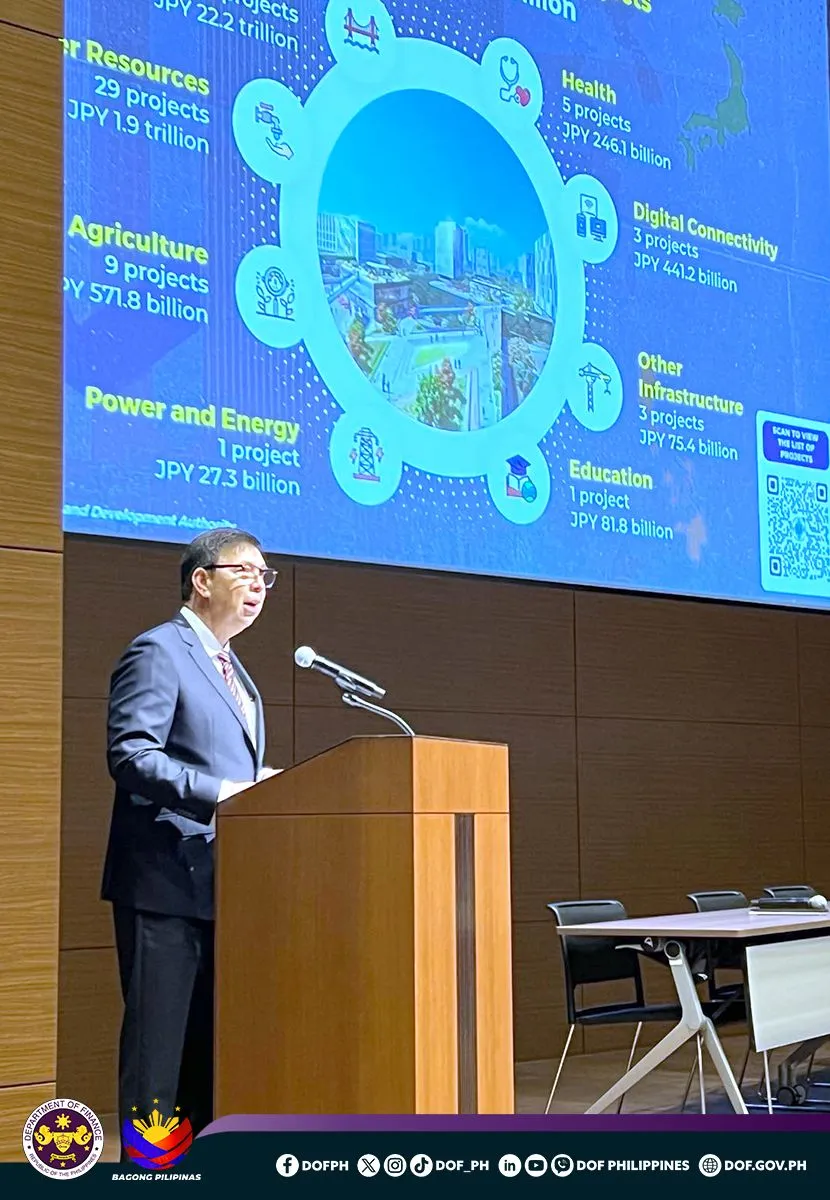

Currently, Japan is the Philippines’ second-biggest trading partner, its largest source of foreign direct investment (FDI), and the top provider of highly concessional official development assistance (ODA). Additionally, Japan remains the largest investor in the Philippines’ economic zones.

Beyond the strong economic ties, Secretary Recto emphasized that the Philippines considers Japan as its best friend in the region due to both nations’ mutual respect and a shared understanding that harmony and security are essential for achieving economic prosperity.

Office of the Special Assistant to the President for Investment and Economic Affairs (OSAPIEA) Secretary Frederick D. Go officially opened the PEB in Tokyo.

During the first panel discussion on shaping a macroeconomic landscape conducive for investments, Secretary Recto was joined by fellow economic managers Department of Budget and Management (DBM) Secretary Amenah F. Pangandaman and National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan; as well as BSP Deputy Governor Francisco G. Dakila, Jr. and Morgan Stanley MUFG Securities Managing Director and Principal Global Economist Chiwoong Lee.

This was followed by a panel discussion on navigating the Philippines’ investment landscape led by Department of Trade and Industry (DTI) Secretary Alfredo E. Pascual; Department of Transportation (DOTr) Secretary Jaime J. Bautista; Department of Energy (DOE) Undersecretary Felix B. Fuentebella; and Bases Conversion and Development Authority (BCDA) President and CEO Joshua M. Bingcang.

The briefing was attended by around 500 Japanese business leaders, investors, and government officials.

Secretary Recto also brought key Filipino conglomerates to the event to testify about the predictability, stability, and sustainability of doing business in the Philippines and forge partnerships with Japanese investors.

The Filipino business leaders include Ramon S. Ang, Vice Chairman, President, and CEO of San Miguel Corporation; Edgar Injap Sia, Chairman of Double Dragon Properties; Cezar Consing, President and CEO of Ayala Corporation; Felcaster D. Torres, President of Yazaki Torres, Inc.; Michael Tan, President and COO of Asia Brewery; Anthony T. Huang, President and CEO of Stores Specialists Group, Inc.; Sean Andre Sy, President and COO of Steel Asia Manufacturing Corporation; and Andrew Gotianun III, Supply Chain Management Head of Filinvest Development Corporation.

Also present were Franklin Gomez, Senior Vice President for Finance of SM Investments Corporation; Carlos Luis Fernandez, General Counsel of Philippine Airlines; Yukinori Kojima, Japan Country Manager and Tokyo Branch General Manager of Metrobank; and Joseph Pelaez, Head of Remittance and Trade Department of Metrobank.

The PEB in Japan was organized by the Department of Finance (DOF) and the Bangko Sentral ng Pilipinas (BSP) in partnership with SMBC, Daiwa Securities Group Inc., Mitsubishi UFJ Morgan Stanley, Mizuho, Nomura, the Japan External Trade Organization (JETRO), the ASEAN-JAPAN CENTRE, and the Japan-Philippines Economic Cooperation Committee (JPECC).